The next step forward for EfW in Australia

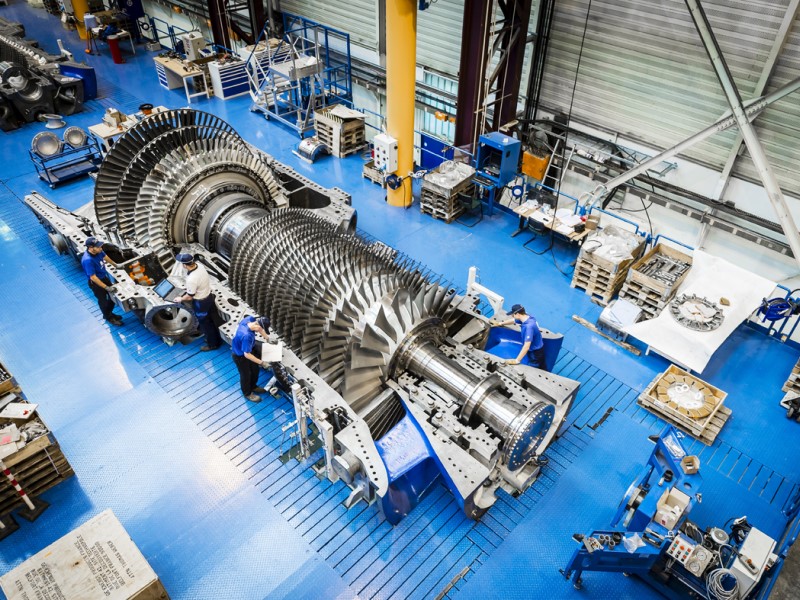

The East Rockingham WTE project is a 300,000 tonne-per-annum energy from waste facility under construction in the Rockingham Industry Zone in the south of Perth. On completion, the facility will deliver a cost-effective waste treatment solution and a vital source of dispatchable renewable energy, whilst achieving a 96% diversion of residual waste from landfill.

With a capital stack comprising best-in-class sponsors (Masdar Tribe Energy, John Laing, Acciona Concesiones and Hitachi Zosen Inova), market-leading senior lenders (NAB, SMBC, ABN AMRO, KfW-IPEX and Mizuho), the Australian Commonwealth Government (CEFC and ARENA), a leading waste management partner and operator in SUEZ and construction by Acciona and HZI, East Rockingham WTE is already serving as an important catalyst for future EfW development in Australia.

The transaction involved numerous “firsts”, chief among which was the “waste arising” contract structure for the critical waste supply agreements with local government authorities, described further later. Equally important was the capital structure innovation harnessed by developers and financiers to bring in a late stage subordinated debt tranche from CEFC and ensure the deal got to close inside calendar 2019.

Here’s a custom-style bullet list:

- Point 1 is lorem ipsum

- There’s a point 2

- The important is point 3

This is a small caption, December 2022 ©AFP

Here someone is quoted saying Lorem Ipsum Dolor Sit Amet

– Author, Date

We could also have two columns…

The East Rockingham WTE project is a 300,000 tonne-per-annum energy from waste facility under construction in the Rockingham Industry Zone in the south of Perth. On completion, the facility will deliver a cost-effective waste treatment solution and a vital source of dispatchable renewable energy, whilst achieving a 96% diversion of residual waste from landfill.

Prior to Financial Close

− Hitachi Zosen Inova AG (HZI)

− New Energy Corporation Pty Ltd (New Energy)

− Tribe Infrastructure Group (Tribe)

1st development deal for HZI

From Financial CloseA$128m commitment

− Masdar Tribe Energy (40%)

− John Laing Investments (40%)

− Acciona Concesiones (10%)

− HZI (10%)

1st investment in Australia

for Masdar

A$307m 5-year

hard mini-perm

senior facility

− Structuring Banks & Mandated Lead Arrangers: SMBC and NAB

− MLAs: ABN AMRO, KfW-IPEX and Mizuho

1st Australian bank into an EfW deal

Here's a blurb with icon

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Here's a blurb with an image

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

I'm just a blurb

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Here’s an important update or call-to-action element

%

of statistics are ignored

%

of statistics are ignored

%

of statistics are ignored

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.